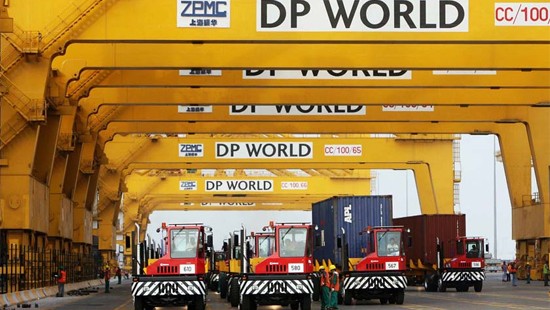

Dubai’s DP World Eyes Dollar Bond – Sources

The Dubai-based firm could raise between $750 million and $1 billion from the bond.

DP World, one of the world’s biggest port operators, wants to issue a dollar-denominated bond and could announce plans to market the deal to investors as soon as this week, three sources aware of the matter said.

The firm could raise between $750 million and $1 billion from the bond issue, depending on investor appetite and the interest rate the company would have to pay to borrow the money, two of the sources said, speaking on condition of anonymity as the information isn’t public.

The firm is likely to issue long-term bonds, with a lifespan of ten years possible, the two Gulf-based sources added.

A spokeswoman for DP World didn’t immediately respond to an emailed request for comment.

The bond plans come at a time when the firm is expanding its operations through acquisitions and many Gulf-based borrowers are turning to the bond market to secure longer-term funding while interest rates remain historically low.

“DP World has always managed its cash very well, and with rates where they are and with the way they are expanding, it shouldn’t be surprising they are choosing to come to the market now,” said a separate Dubai-based banker, who spoke on condition of anonymity as he wasn’t authorised to speak to the media.

Earlier this month, DP World agreed to buy Canada’s Fairview Container Terminal from Deutsche Bank for C$580 million ($477 million).

It also purchased Economic Zones World from its majority shareholder, Dubai World, at the end of last year in a deal worth $2.6 billion to its parent.

One of the Gulf-based sources said the banks arranging the bond deal were Citigroup, Deutsche Bank, Emirates NBD, HSBC, National Bank of Abu Dhabi and Societe Generale, with the caveat that the group could potentially add more lenders prior to the announcement of the deal.

The same six banks are on the company’s base prospectus for its $5 billion global medium term note programme, an update of which was published on April 13.

Other fundraising initiatives by DP World in recent months include a $3 billion loan which tripled an existing loan at cheaper pricing in June, and a debut $1 billion convertible bond with a ten year lifespan in June.

DP World posted an 11.8 per cent rise in 2014 net profit as profit margins grew in all its regions.