Revealed: Where in the UK are GCC investors buying property?

Cities outside of the capital see rising interest from GCC buyers

Sponsored: Over two-thirds of GCC investors stated that the UK is one of the top overseas property investment destinations, a new study shows.

The research, commissioned by UK developer Select Property Group and conducted by YouGov, reveals the current investment trends and attitudes in the GCC.

Real estate was unsurprisingly the most popular asset across the region, with 60 per cent of respondents considering an overseas real estate investment in the future.

“As GCC investors become increasingly interested in overseas investment opportunities, they’re setting their sights on the UK property market, with a noticeable shift towards the significance of northern cities,” said Adam Price, managing director at Select Property Group.

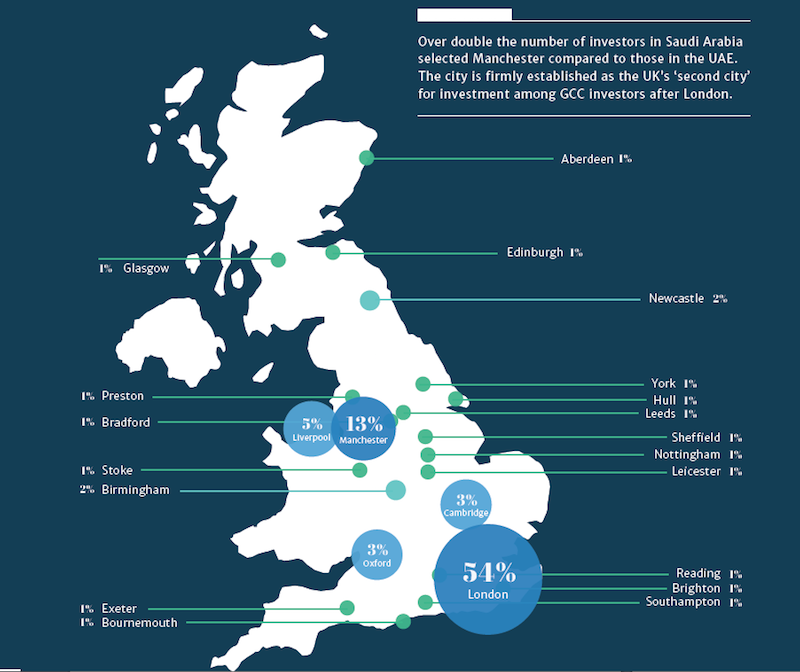

Among those surveyed, 54 per cent chose London as the UK city of choice for property investment. Strongest capital growth (33 per cent) and the highest yields (22 per cent) were the main factors that influenced investors’ decisions. However, the UK capital doesn’t actually offer the strongest capital returns.

“While these cities were chosen based on capital growth potential, it is Manchester, not London, where property prices are rising fastest in the UK,” the report stated.

Also, the average rental yields in Manchester are 67 per cent higher than those in London, according to Select Property.

Manchester was chosen by 13 per cent of the respondents, while Liverpool came third (5 per cent). Cambridge and Oxford came next (3 per cent), followed by Newcastle and Birmingham (2 per cent).

Research from JLL Residential states that Manchester saw a 52 per cent rise increase in apartment property prices from 2011-2017, with residential property price forecast to grow 22.8 per cent between 2018 and 2022 – growth that’s 81 per cent higher than the UK average.

In 2017, the average rental price of a two-bedroom apartment in the city rose 3.2 per cent, and residential rents across the board are forecast to increase 17.6 per cent between 2018 and 2022 – 40 per cent faster than the national average.

“GCC investors are already capitalising on this growth potential, with 63 per cent of our Manchester portfolio being purchased by investors in the region,” added Price.

Manchester is of particular interest to investors from Saudi Arabia, with over double the number of respondents selecting Manchester than other GCC countries.

With a UK property portfolio worth over GBP 1.5bn (almost $2bn), Select Property Group has delivered thousands of properties with returns in excess of GBP 100m ($132.6m).

With a focus on Manchester, the company claims some of the strongest investment opportunities in the city, with a diverse range of options suited to varying investor motives.

From premium residential properties to luxury serviced apartments with guaranteed returns, Select’s portfolio has been particularly attractive to GCC investors in recent years.

Select is currently retailing properties in two newly-launched projects, Origin Homes and CitySuites, both located in at the heart of Manchester’s central business and retail district. Construction is already underway.

For further details on Select’s current investment opportunities, please click HERE

Read the full GCC investor report HERE.